Closing the Retirement Gap Using Home Equity

Learning Objectives

Section 1

- The Basics

Section 2

- Program Features

Section 3

- Other Details

Section 4

- Loan Process

Section 5

- Scenarios and Uses

Section 6

- Summary

The Importance of Home Equity

“New academic research demonstrates how HECMs can play a vital role in retirement planning – not just as a tool of last resort but as a strategic way to provide greater financial flexibility to seniors with ample savings.”

Source: Salter, Pfeiffer, and Evensky. “Standby Reverse Mortgages: A Risk Management Tool for Retirement.” Journal of Financial Planning, 2012, https://www.myirionline.org/docs/default-source/research/boomer-expectations-for-retirement-2016.pdf

Home Equity Conversion Mortgage

The Home Equity Conversion Mortgage (HECM) is a loan that:

- Gives borrowers access to a portion of their home value.

- Requires no payments until the last borrower permanently leaves the home, or if another maturity event occurs. Note: The borrower must pay property charges, including property taxes, fees, and hazard insurance.

- Is non-recourse, which means that the lender can use only the property for lien satisfaction.

- Allows borrowers to retain title at all times.

Reasons to Consider a HECM

- Eliminate a monthly mortgage payment*

- Supplement income

- Pay for medical expenses or in-home care

- Finance the purchase of a new home

- Pay off debt

- Enjoy passions with financial ease

*Borrowers must pay taxes and insurance.

HECM Eligibility Requirements

All borrowers must:

- Be age 62 or older.

- Live in the subject property as their primary residence.

- Demonstrate financial capacity and credit responsibility.

- Attend an FHA approved consumer counseling session and obtain a HECM Counseling Certificate.

Eligible Properties

Eligible properties include:

- Single-family homes

- FHA approved condominiums

- Townhomes or Planned Unit Developments (PUDs)

- Two-to-four unit properties that are owner-occupied

- Manufactured homes that meet HUD guidelines

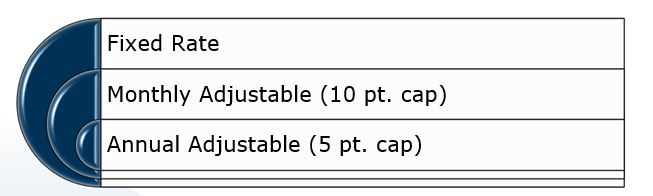

HECM Product Options

FHA Insured Products

Proprietary Program

FAR’s HomeSafe® jumbo program is a fixed-rate ONLY product with a maximum loan amount of $4,000,000.

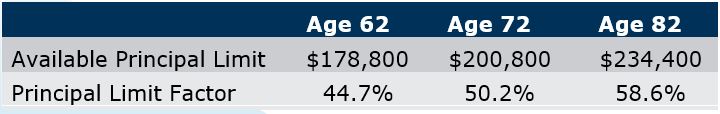

Principal Limits

The initial Principal Limit (PL) is defined as the maximum amount available to a HECM borrower at the time of closing. The PL is calculate using tables provided by HUD. These include:

- The age of the youngest borrower, or eligible non-borrowing spouse

- The lesser of the home’s current appraised market value, or the FHA lending limit ($726,525)

- The expected interest rate (Libor 10 yr. swap plus lender margin)

Additional Factors

Here are some additional factors contributing to the available principal limit:

- Higher ages usually result in higher principal limits

- Higher expected rates generally result in lower principal limits

- Any mortgage liens must be paid out of the proceeds

The example below illustrates the difference age makes in determining the available proceeds.

The example assumes a maximum claim amount (MCA) of $400,000 and an expected rate of 4.35%.

Note: This is for demonstration purposes only and is based upon estimates only. The borrower must meet all loan obligations, including living in the property as the principal residence and paying property charges, including property taxes, fees, and hazard insurance.

Program Features

For Adjustable Rate Loans

- Line of Credit: Grows over time based upon current interest rates.

- Tenure: Provides equal monthly payments during the life of the loan.

- Term: Provides payments for a specific amount and time period.

- Up-front draw: An immediate lumpsum withdrawal at closing.

- Any combination of these

For Fixed Rate Loans

- Up-front draw: An immediate lump sum withdrawal at closing.

HECM Feature: Line of Credit

An unused Line of Credit grows at the same rate as the interest and FHA Mortgage Insurance Premium, which is charged on any outstanding loan balance. The Line of Credit:

- Cannot be frozen due to a change in home value.

- Has no term limits or balloon payments.

- Has funds that can be accessed, paid back if desired, and then accessed again at a future date.

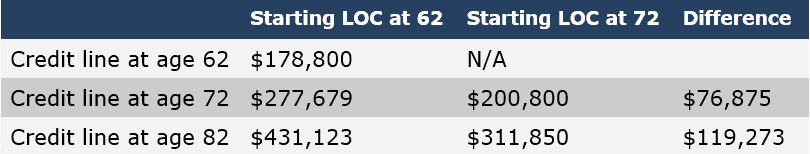

HECM LOC: Now or in 10 Years?

This chart is based on a $400,000 house and an expected rate of 4.35%. The available line of credit (LOC) does not assume any closing costs were deducted.

Note: This is for demonstration purposes only and is based upon estimates only. Actualperformance may vary depending upon interest rate and line of credit utilization.

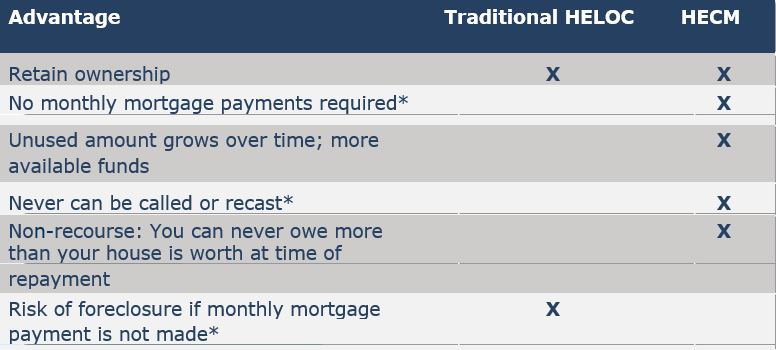

Line of Credit vs. HELOC

HECM Feature: Tenure Payments

The Tenure payment plan allows you to:

- Use some or all available funds for equal monthly payments for the life of the HECM.

- Change the payment plan at any time with a fee to the servicer.

Note: Under the plan, monthly payments are paid as long as the borrower lives in the home and abides by the terms of the loan including maintaining the property and paying taxes and insurance.

HECM Feature: Term Payments

The Term payment plan includes:

- A specific dollar amount from available HECM proceeds to be received for a specific period of time.

- Monthly checks that stop at the end of a pre-determined period of time. However, the loan does not become due and payable until a maturity event occurs.

HECM for Purchase

Requirements

- A HECM for Purchase requires a borrower contribution based on a percentage of the purchase price and the borrower’s age. The balance of the funds for purchase come from the HECM loan.

- The property must be the borrower’s primary residence and meet FHA property guidelines.

Benefits

- As with any mortgage, the borrower owns the house, and his or her name is on the title.

- Monthly mortgage payments are NOT required. Payment is deferred until a maturity event occurs.

- Borrowers spend less money out of pocket, and preserve more of their savings instead of spending it on their home.

- Borrowers can get more home for their money. A HECM for Purchase could help them comfortably afford upgrades or a more expensive home.

- There’s an opportunity to “right-size” their home or move closer to family.

HECM for Purchase: Example

A 62 year-old borrower would like to purchase a $400,000 home. Using the HECM for Purchase, the borrower provides only $233,200 of his or her own funds for an equity contribution. The HECM for Purchase finances the balance of the purchase price.

The chart below illustrates various borrower equity contributions with varying ages and purchase prices.

| AGE | $400,000 | $500,00 | $600,0 |

| 62 | $233,200 | $290,500 | $347,80 |

| 72 | $211,200 | $263,000 | $314,80 |

| 82 | $177,600 | $221,000 | $264,40 |

The example assumes an expected rate of 4.35%, an upfront MIP of 2%, and third party closing costs of $4,000.

HomeSafe®

HomeSafe® is Finance of America Reverse’s proprietary, jumbo reverse mortgage product. The HomeSafe® was designed specifically for owners of high-value homes. If you’re 62 or older, now you can access even more of your home’s equity and put it to work wherever you want – giving you more control over your assets, investments, and cash flow.

The HomeSafe® features:

- Higher valued properties with maximum loan amounts up to $4 million.

- Lower fees with no mortgage insurance premium.

- No initial disbursement limitation.

- Condominiums require FHA approval unless they are valued at greater than $500,000.

The Costs

Financed closing costs include:

- Upfront mortgage insurance premium, which is 2% of the Max Claim Amount

- Origination fee, depending on the loan product

- Traditional third-party closing costs

Withdrawal Restrictions

The first year fund withdrawal restrictions are the greater of the Principal Limit OR the Mandatory Obligations plus 10% of the Principal Limit.

Mandatory Obligations are the liens, existing mortgage and HELOC payoffs, and closing costs.

Example:

If the Mandatory Obligations are less than the Principal Limit.

- 62 year-old borrowers

- Home value: $400,000

- Expected rate: 4.35%

- Available Principal Limit: $178,800

- 60% of available Principal Limit: $107,280

- Total available funds in year one: $107,280

- Balance of LOC: $71,520, which can be accessed in year two.

Example:

If the Mandatory Obligations are greater than the Principal Limit.

- 62 year-old borrowers

- Home value: $400,000

- Expected rate: 4.35%

- Available Principal Limit: $178,800

- 60% of available Principal Limit: $107,280

- Mandatory Obligations: $130,000

- Total available funds in year one = Mandatory Obligations ($130,000) plus 10% of Principal Limit ($17,880): $147,880

- Balance of LOC: $30,902, which can be accessed in year two.

Life Expectancy Set-Aside

“Life Expectancy” set-asides are established at closing and are payable ONLY toward taxes, assessments, and insurance (hazard and flood).

These set-asides can be required due to an insufficient qualifying profile, or are optional at the borrower’s request.

Consumer Protections

Mandatory FHA Counseling sessions are required for borrowers, non-borrowing spouses, and POAs. This screens for competency and comprehension of the loan program.

Financial Assessment determines if the borrower has the financial capacity to pay taxes and insurance, and ongoing maintenance of the property.

Non-Borrowing Spouse Rules make it possible for a qualified non-borrowing spouse to remain in the home even if the borrower dies.

Non-Recourse Property Protection for borrowers and heirs ensures the loan payoff is secured by the property. Borrowers and heirs can never owe more than the house is worth when the loan is repaid.

No Pre-payment Penalty provision means the borrower can pay down the loan at any time or defer payment.

Loan Process: Education

- A loan officer can help you determine if a reverse mortgage is the right solution for you, and if so, which type best fits your goals and needs.

- We’ll assess your individual needs and financial situation, thoroughly explain everything, and prepare you for your independent counseling session.

- We encourage you to include your family members and trusted advisors in your decision-making process.

Loan Process: Counseling

- To ensure that you understand all aspects of a reverse mortgage, you are required to have a session with an independent counselor who is approved by the U.S. Department of Housing and Urban Development (HUD).

- This session is usually 60 to 90 minutes, and can be in-person or over the phone.

Note: Some states require face-to-face counseling.

Loan Process: Application

- Your loan officer helps you complete the application and collects your documentation. He or she lets you know exactly what documents to provide.

Loan Process: Closing

- Once the loan is approved and final documents are ready for your signature, we contact you to schedule your loan closing. This can take place at your home.

- Any existing mortgage(s) will be paid off from a portion of the reverse mortgage proceeds.

- After closing and any applicable rescission period, the loan funds, and you receive your money.

Appraisal

The HECM is a non-recourse loan which means that the home is the only collateral used for repayment. Therefore it is important that an accurate determination of the property value and property condition is obtained.

The Federal Housing Administration (FHA) requires that all homes submitted for insuring be safe, sound, and secure, which means they require an appraisal inspection and report completed by an FHA-approved appraiser.

The appraised home value is one of the factors used in determining the loan proceeds available, or “principal limit”.

Note: Principal limit calculations are based on the lower of the appraised value,maximum claim limit ($726,525) or purchase price.

Effective for all case numbers

assigned on or after October 1st, 2018, FHA requires that a collateral assessment be

performed on all HECM loans prior to closing. Based on the outcome

of the assessment, FHA may require a second appraisal be obtained prior to

approving the loan.

Note: The lower of the two appraised values must be used.

Your HECM, Your Way

This powerful financial option can be an important part of a retirement funding strategy. HECM uses are as unique as the individual adult homeowner it is specifically designed for.

The use of a HECM can afford the opportunity to enhance the quality of life for the adult homeowner…

…because quality of life should not decrease with age.

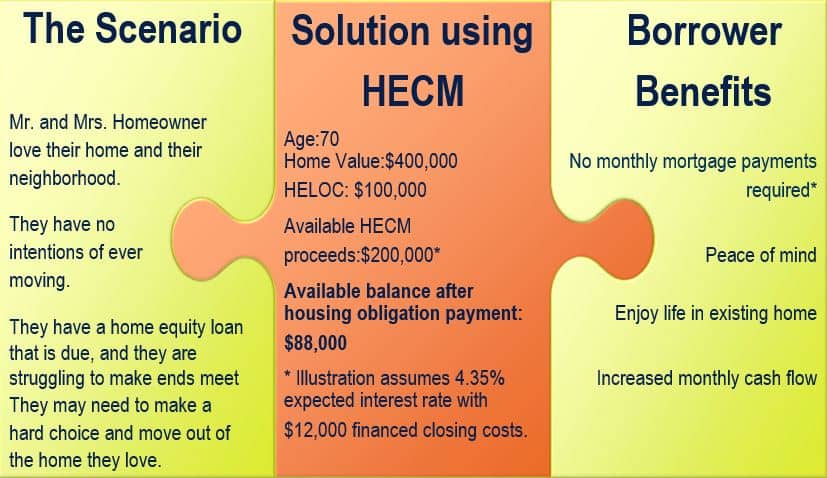

Example: Refinance

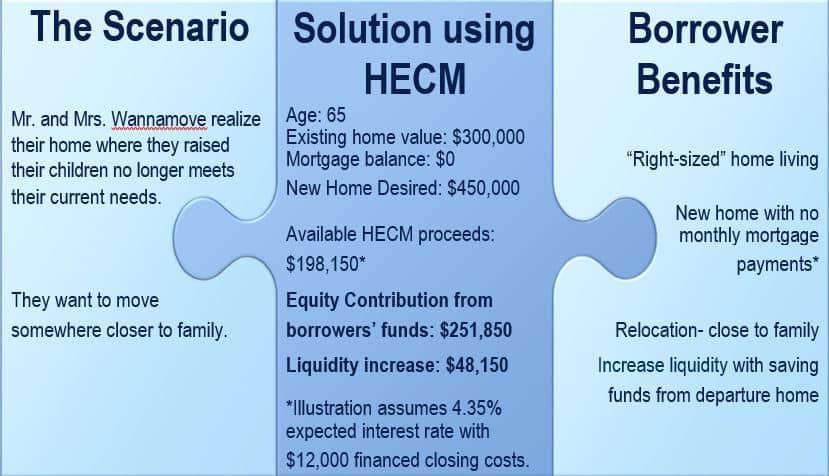

Example: New Home Purchase

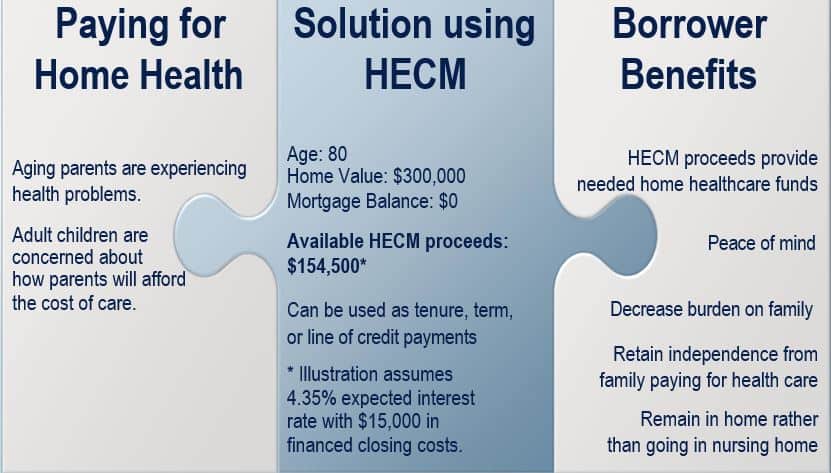

Example: Aging Concerns

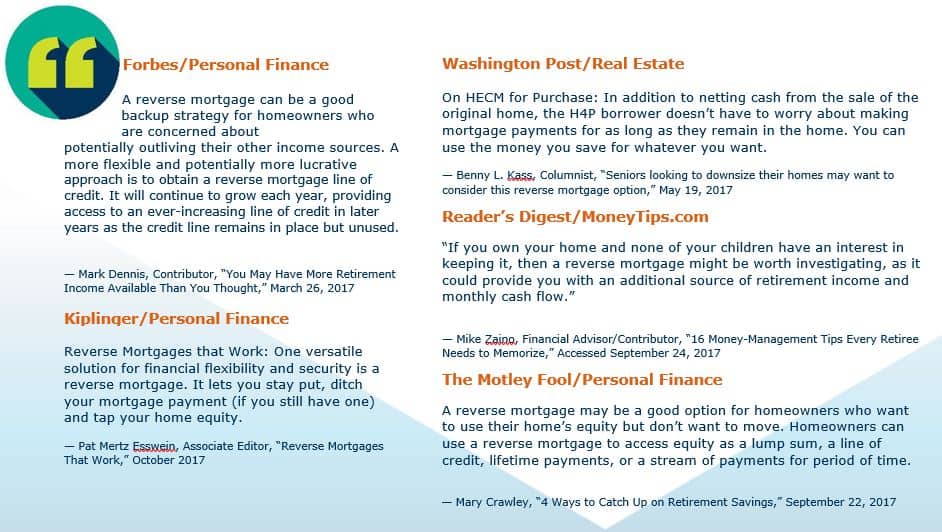

HECMs in Media and Research