Blog

Housing Market Forecasts for the Second Half of 2025

Are you wondering what to expect if you buy or sell a home in the second half of the year? Here’s what the expert forecasts tell you: Mortgage rates are expected to come down slightly. Experts project rates should be in the mid-to-low 6% range by the end of the year as greater certainty unfolds…

What an Economic Slowdown Could Mean for the Housing Market

Talk about the economy is all over the news, and the odds of a recession are rising this year. That’s leaving a lot of people wondering what it means for the value of their home – and their buying power. Let’s take a look at some historical data to show what’s happening in the housing…

What You Can Do When Mortgage Rates are a Moving Target!

Have you seen where mortgage rates have been lately? One day they go down a little…the next day they go back up again! It can feel confusing and even frustrating if you’re trying to decide whether now’s a good time to buy a home. Take a look at this graph–it uses data from Mortgage News…

Are Investors ACTUALLY Buying Up All the Homes?

Are you in the market to buy a home but feel like you’re up against investors snatching up everything in sight? Many people believe mega investors are driving up prices and buying all the homes for sale and that’s what’s making it hard for regular buyers like you to compete. But here’s the truth: investor…

Buy Now, or Wait?

If you’ve been wondering if you should buy now or wait–here’s what you need to know! If you wait for rates to drop, you’ll have to deal with more competition and higher prices as additional buyers jump back in. But if you buy now, you’ll get ahead of that and have the chance to start…

What Mortgage Rate Are You Waiting For?

You won’t find anyone who’s going to argue that mortgage rates have had a big impact on housing affordability over the past couple of years. But there is hope on the horizon! Rates have actually started to come down and recently they hit the lowest point we’ve seen in 2024, according to Freddie Mac: And…

Homebuyer Opportunities in 2024

We know this past year has been difficult for homebuyers. If you’re someone who had started the process of searching for a home and then put your search on hold because the challenges in today’s market felt like too much to take on–you’re not alone in that! A Bright MLS study found that some of…

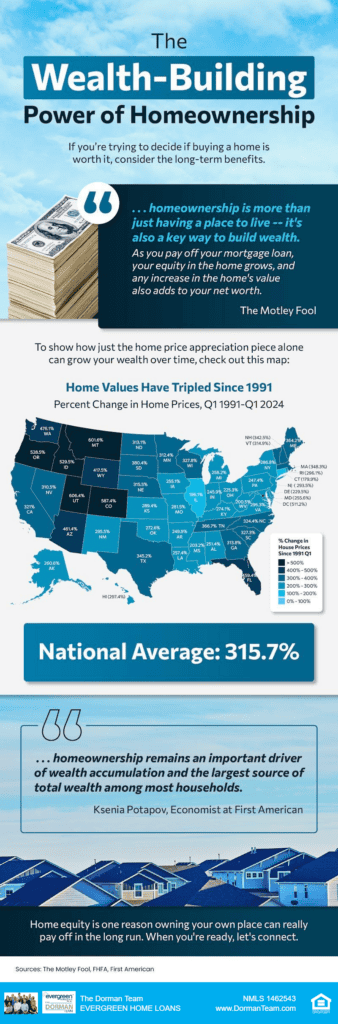

The Power of Homeownership

If you’re trying to decide if buying a home is worth it, consider the long-term benefits! Like building equity as home values grow over time. According to the FHFA, home values have increased by 315.7% since 1991. Home equity is one reason owning your own place can really pay off in the long run! Let’s…

Reverse Mortgage Myths!

Common myths and misconceptions surrounding Reverse Mortgages, let’s clear some things up! Myth #1: The Bank Owns Your Home: not true! With a Reverse Mortgage, homeowners retain ownership and title of their home just like a traditional mortgage, the lender only has a lien against the property to secure the loan. Myth #2: You Can…

Steps to Buying a Home!

Where to start when buying a home? Doing things in the right order can save you a lot time, stress and money! Step One: get pre-approved! Step Two: make a list of what you want and need in the home you want to buy Step Three: find a qualified, local real estate agent to help…