Blog

Homebuyer Opportunities in 2024

We know this past year has been difficult for homebuyers. If you’re someone who had started the process of searching for a home and then put your search on hold because the challenges in today’s market felt like too much to take on–you’re not alone in that! A Bright MLS study found that some of…

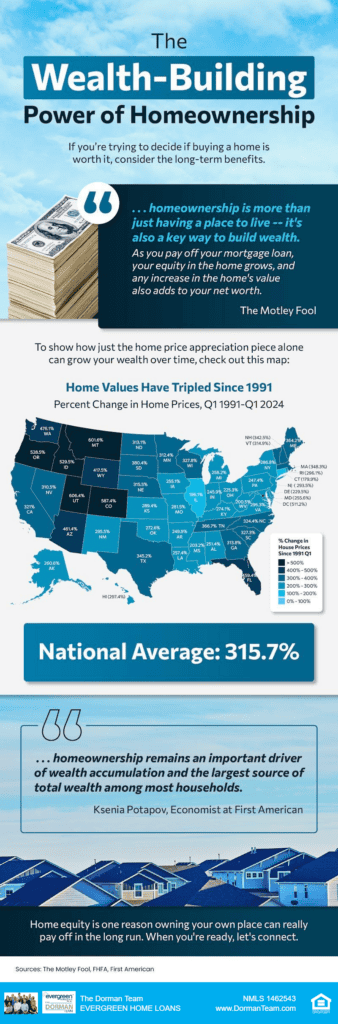

The Power of Homeownership

If you’re trying to decide if buying a home is worth it, consider the long-term benefits! Like building equity as home values grow over time. According to the FHFA, home values have increased by 315.7% since 1991. Home equity is one reason owning your own place can really pay off in the long run! Let’s…

Reverse Mortgage Myths!

Common myths and misconceptions surrounding Reverse Mortgages, let’s clear some things up! Myth #1: The Bank Owns Your Home: not true! With a Reverse Mortgage, homeowners retain ownership and title of their home just like a traditional mortgage, the lender only has a lien against the property to secure the loan. Myth #2: You Can…

Steps to Buying a Home!

Where to start when buying a home? Doing things in the right order can save you a lot time, stress and money! Step One: get pre-approved! Step Two: make a list of what you want and need in the home you want to buy Step Three: find a qualified, local real estate agent to help…

The Significance of Mortgage Lending for Seniors!

For many seniors, their home represents a substantial portion of their wealth. Making informed decisions about mortgage lending can have a significant impact on their financial security and quality of life. Here are some key reasons why this topic is so crucial for seniors: Financial Stability in Retirement: Choosing the right mortgage option can help seniors…

Let’s Talk About Down Payment!

There’s a lot of questions people have surrounding down payment–is 20% a requirement? Not at all, there are definitely other alternatives! There’s down payment assistance options, there’s programs that allow you to put 0% down or a little down. We’d love to coach you through it, give us a call today! 206-590-2414

3 Steps When Buying A Home

There’s a few things to consider before you buy a home: 1- are you going to be living in the home for at least three years? 2- do you have a solid job and any savings for a down payment or other costs? 3- are you comfortable with the mortgage payment? We are here to…

Getting Pre-Approved!

How long does it take to get pre-approved for a home loan? And how long does that pre-approval last? Great questions! Getting pre-approved can be a very fast process, it depends on how quickly you can help us navigate gathering documents and getting us all the necessary information. Sometimes you can be pre-approved within 24…

Keep It Simple!

When buying a home, sometimes we over complicate things! Let’s breakdown the process as simply as possible: 1-Get your financing set up 2-Find the home you want to buy 3-Close on that home! While there are complications that can occur, it’s our top goal to walk you through every step of the way to make…

Do I need a Co-Signer?

We often get questions from our borrowers about what happens if they don’t qualify for a home loan on their own? What options do you have for a co-signer? Can they be a family member or friend? A significant other? Or do you have to be married? We would be happy to coach you through…