Blog

Selling Your Home in the Summer – Good or Bad?

If you want to sell your house, consider doing it now. In the summer, the days are longer, the weather is warmer, and it’s a great time for sellers! It’s summer and maybe you’re wishing you had more room to host and entertain your friends and family or maybe you want to live somewhere with…

What Homebuyers NEED to Know about Credit Scores!

If you’ve been thinking about buying a home, you should know your credit score is a critical piece of the puzzle when it comes to qualifying for a home loan. Lenders review your credit to assess your ability to make payments on time, pay back debts and more. It’s also a factor that helps determine…

Aging in Place and What Resources You Can Utilize!

The National Council on Aging (NCOA) is a great resource as an option to “age in place,” as is a reverse mortgage! Read below for some of the benefits of these options. National Council on Aging Resource As people age, they may begin to experience changes in their physical and cognitive abilities which can make…

What You Need Now is More Important Than Today’s Rates

If you’ve been thinking of selling your house, odds are it’s because something in your life has changed. And while things like mortgage rates are a key part of your decision on what you’ll buy next, it’s important not to lose sight of why you want to make a change in the first place! It…

What’s Required for a Reverse Mortgage?

If you’ve been wondering if you qualify for a reverse mortgage or what the requirements even are–here’s a simple breakdown of some of the things you should know! A reverse mortgage is a loan that allows homeowners aged 55 or older to access equity in their home. Unlike traditional mortgages, with a reverse mortgage, the…

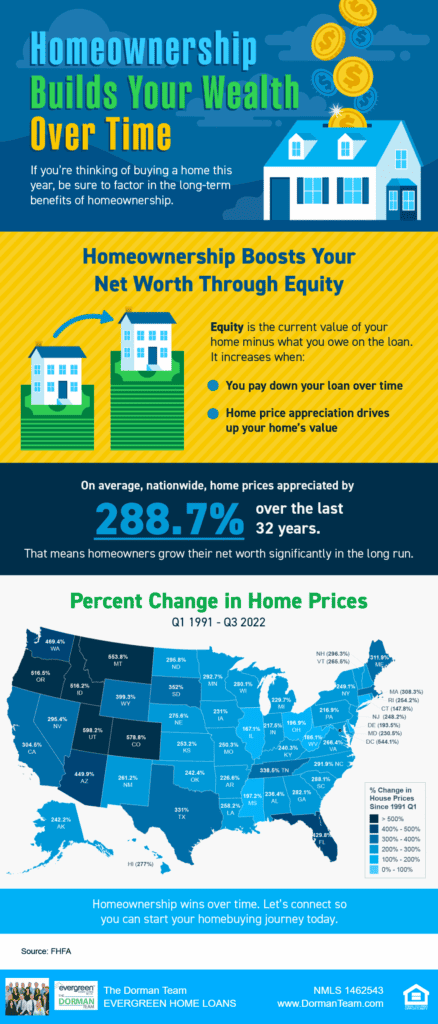

Building Wealth Through Homeownership

If you’re thinking of buying a home this year, make sure you factor in those long term benefits! On average nationwide, home prices appreciated by 288.7% over the last 30 years. This means homeowners grow their net worth significantly long term. Don’t miss out on starting your home wealth building opportunity and give us a…

Waiting for 3% Mortgage Rates? You May Want to Rethink That

Last year, the Federal Reserve took action to bring down inflation. In response to that mortgage rates jumped up from the record lows we saw in 2021, stopping at just over 7% this last October. A lot of buyers decided to hold off on their homebuying plans because of this increase in rates. Today the…

What do you know about Reverse Mortgages?

For a lot of people Reverse Mortgages are something they’ve either never heard of or are very unfamiliar with–so let’s break this program down! What’s the Difference between a Reverse Mortgage and a HECM (Home Equity Conversion Mortgage)? -HECM is backed by FHA/HUD with multiple safeguards in place to protect our seniors. Since it is…