Blog

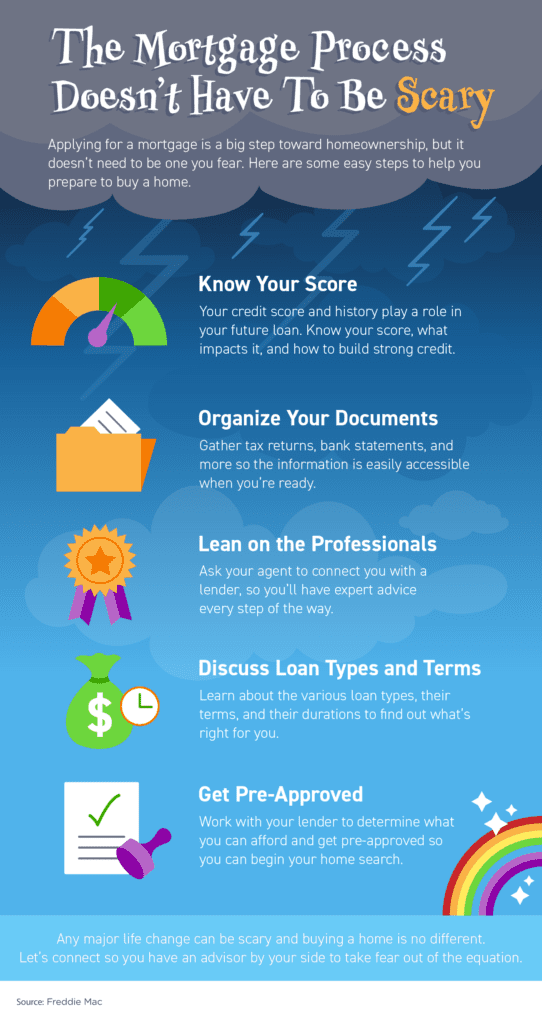

The Mortgage Process Doesn’t Have to be Scary!

Applying for a mortgage is definitely a big step, but it doesn’t need to be one you fear. Breaking down the process into simple steps can take the uncertainty out of the mortgage process. Step 1- Know your credit score. This is a great starting point because your credit score and history have a big…

CashUp Program by Evergreen

CashUp by Evergreen can help you serve buyers and grow your business more efficiently! Turn your house hunter into a cash buyer – With CashUp by Evergreen, homebuyers are preapproved as cash buyers up front with a fully underwritten credit package. Up the offer with no financing and no appraisal contingency – When your clients…

REDUCE HOME HEATING COSTS

Some simple things you can do to cut down on your heating bills, save money and keep your house warm! Read on for energy saving tips… Now that the weather is starting to cool down, you might be dreading that utility bill coming your way! There are some simple changes you can make to keep…

Evergreen News Flash!

In anticipation of the Federal Housing Finance Agency (FHFA), we’re announcing increasing the maximum conforming loan limits for mortgages acquired by Fannie Mae and Freddie Mac in 2022. Evergreen will allow the following temporary 2022 Conventional Conforming loan amounts effective immediately: 1 unit – $625,000 2 unit – $800,250 3 unit – $967,250 4 unit…

The Cost of Waiting…

If you wait for a lower mortgage rate – it could cost you! The housing market today is truly one for the record books. We’ve seen the lowest mortgage rates in HISTORY. While the rates seemed to bottom out at the beginning of 2021, the window of opportunity for buyers isn’t over yet. If you’ve…

Refi Now!

Contact us today to see how a mortgage refinance can help you hit your financial goals. You can pay off debt, lower your rate, lower your payment, drop mortgage insurance if you have it now, use your equity to buy another home, and more! These record low rates will not wait for you. Take action…